Posts

Taking help from a professional makes some thing much easier, lower your fret, and you will replace your probability of achievements. Finally, private issues for example past beliefs, monetary difficulties, otherwise changes in their relationships position tends to make the process harder. For those who face these items, it’s crucial that you get assistance from a legal specialist. They’re able to assist you in navigating such challenges and you may presenting your own circumstances really. This includes proof of your location, debt condition, English code experience, and you will a flush criminal background.

The new Character of Proof Target

When you get their permanent house, searching to the getting an uk https://vogueplay.com/in/pharaons-gold-iii/ resident. Allowing you like the benefits of living in the united kingdom for some time. For those who have much more inquiries otherwise need assistance, listed below are some our very own FAQ section for more information. Long lasting household and you can Long Exit to stay (ILR) are a couple of ways to accept in britain. ILR allows you to real time, work, and study in the united kingdom with no immigration laws holding you straight back.

Rational possessions (IP)

Therefore, When you’re calculated getting a low-citizen from the automated overseas examination, you don’t have to take on the next screening. And, for many who performs during your education, you never shell out taxation if the nation have a two fold taxation contract for the United kingdom – nevertheless might need to spend they of your property country. You don’t need to worry about British tax on your international income otherwise development, so long as you’lso are using them for very first things such as eating, book, tuition percentage, etc.

Such as, Lloyds Bank brings international currency import functions, such as global bank otherwise offers account, to have low-residents. As well, Barclays Around the world also offers some characteristics, as well as mortgages, opportunities, forex discounts profile, or other banking functions. Specific conditions are proving label and you can abode and you may getting information regarding your earnings. At the same time, of many banking institutions supply options to open discounts and you may investment accounts, that is an important thought based on your financial desires.

For those who own an internet team, startup, or any overseas-work with corporation, fintechs are the most suitable choice for your needs, enabling you to open a business savings account 100% on the internet and from another location. Usually, such fintechs render services the same as that from highest-street financial institutions, such account opening, transmits, debit notes, domestic and you can global transfers, money, ATMs functions, and consultancy. Simultaneously, specific fintech businesses actually enable it to be automated costs as a result of API integrations.

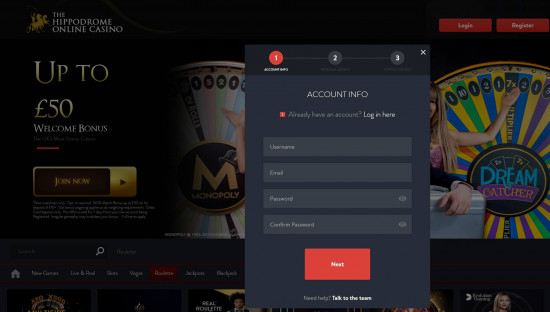

At the same time, several bank account are offered free of charge in the uk. Certain banking companies even have marketing offers, including providing around £250 to own using him or her otherwise taking packaged membership which have advantages such as a mobile phone otherwise travel cover. Although not, opening a checking account in britain since the a non-resident comes with its very own number of difficulties. One of the main challenges non-people deal with is offering proof address. Conventional banking institutions take care of the discernment to help you reject account starting, thus understanding the fundamentals of the Uk bank operating system is extremely important.

Younger Mans Book Prize

Another picture are taken from some other webpage of your fact piece. We hope by purchasing our very own shares away from possibly of them we would like to end Us house tax legislation. Again, that’s likely to be a bonus to have preserving to the taxes to possess all of us. For example, Ireland provides a double-taxation treaty for the Us enabling most Irish domiciled ETFs to get dividends from You businesses immediately after a great 15% deduction to own withholding income tax.

Streaming info on the Resident to the Hulu that have Max

Your own personal tax allotment may also be used with the bonus and private discounts allowances, that is going to imply the majority of people life style to another country merely obtained’t pay taxation to their attention. During the time of creating the non-public allowance tolerance to possess earnings tax are £several,570 and also the you to to own investment progress taxation (CGT) are £step 3,100. This type of banks can offer Euro family savings alternatives, in addition to current accounts with advantages such worldwide money transmits and you will multi-currency membership choices.

- Register for the UKVI account to check on that your eVisa is related to the most recent passport otherwise traveling file.

- To make use of this specific service, you’ll have to show their identity having fun with GOV.United kingdom One to Login.

- We now have checked a variety of services and you may our very own find to find the best VPN overall are ExpressVPN.

- Simultaneously, those individuals provided a good four-12 months long log off to remain also are qualified to receive BRPs which have a termination time of December 31st, 2024.

- For this reason, If you are calculated getting a non-resident from automatic overseas tests, you do not have to adopt the next tests.

Knowledge Immigration Reputation

You also need to help you fill out the brand new SA109 setting if you are a low-resident. Discover if or not you nevertheless still need to help you file your United kingdom taxation to your HMRC, as well as the facts for the when, where, and exactly how. Since the an entire-service firm, we are able to provide good advice and you will information about an extensive directory of other problems. What number of ties you may have will determine exactly how many days you could purchase in britain without having to be addressed because the Uk resident. One other way to be instantly British citizen is when you works full-time in britain over the course of the entire year, rather than extreme getaways.